Are you a homeowner? Do you know why basic property insurance is crucial for you? Find out in this article!

Discover the coverage options available, the benefits of having property insurance, and factors to consider when selecting a policy.

Understanding the claims process will also be explained.

Don’t miss out on the essential information you need to protect your most valuable asset – your home.

Importance of Property Insurance for Homeowners

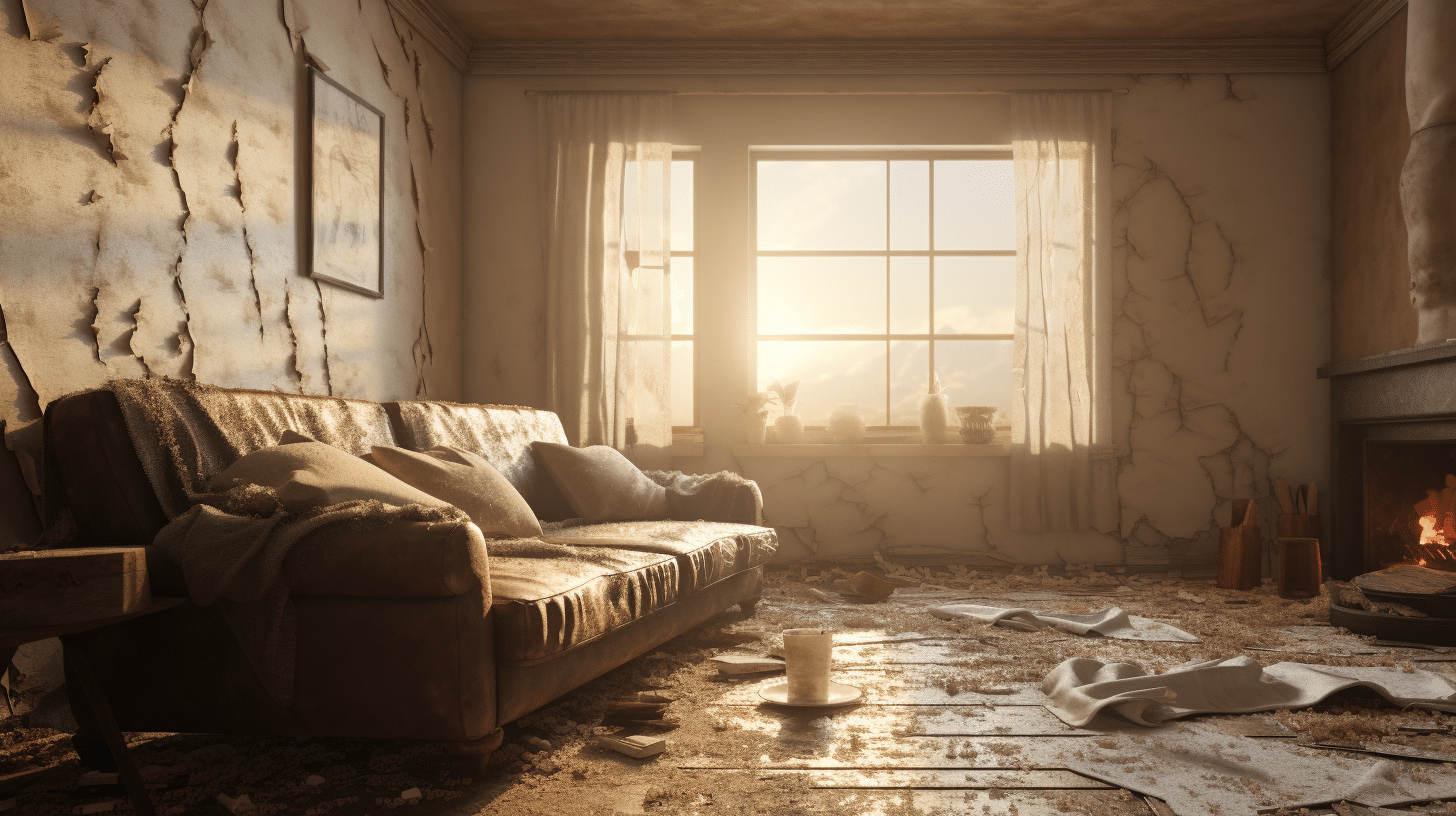

Property insurance is essential for homeowners because it provides financial protection against unexpected events and damages to your property. When you own a home, you invest a significant amount of money and time into it. However, unforeseen events such as natural disasters, theft, or accidents can cause significant damage to your property, leaving you with a large financial burden.

Property insurance helps protect you from these unexpected events by covering the costs of repairs or replacements. For example, if your home is damaged by a fire or a storm, your insurance policy will cover the expenses to rebuild or repair your home. Without property insurance, you’d have to bear these costs on your own, which can be financially devastating.

Therefore, having property insurance provides you with peace of mind and ensures that you’re financially protected against unforeseen events.

Coverage Options for Basic Property Insurance

When it comes to basic property insurance, homeowners have several coverage options to choose from. These options allow homeowners to customize their policies based on their individual needs and budget.

One common coverage option is dwelling coverage, which protects the physical structure of your home in case of damage or destruction caused by covered perils such as fire, windstorms, or vandalism.

Another option is personal property coverage, which covers your belongings such as furniture, appliances, and clothing in case of theft, damage, or loss.

Liability coverage is also essential, as it protects you financially if someone is injured on your property and decides to sue.

Additional coverage options may include loss of use coverage, which helps cover living expenses if your home is uninhabitable, and medical payments coverage, which covers medical expenses if someone is injured on your property.

It’s important to carefully review these coverage options and choose the ones that best fit your needs to ensure that you have adequate protection for your property.

Benefits of Having Basic Property Insurance

Having basic property insurance provides homeowners with essential financial protection against unexpected events and potential losses.

One of the main benefits of having basic property insurance is that it covers the repair or replacement costs of your home in case of damage caused by covered perils such as fire, theft, or natural disasters. This means that you won’t have to bear the entire financial burden yourself, which can be a huge relief during difficult times.

Additionally, basic property insurance also provides liability coverage, which helps protect you in case someone gets injured on your property and sues you for damages. This coverage can help cover legal fees and any settlements or judgments against you.

Factors to Consider When Selecting Property Insurance

Before selecting property insurance, it’s important to consider several factors that will ensure you choose the right coverage for your needs.

First and foremost, you need to assess the value of your property. This includes not only the physical structure, but also your personal belongings and any improvements you have made.

Additionally, you should consider the location of your property. Is it in an area prone to natural disasters or high crime rates? These factors can affect the cost of coverage and the types of risks you need protection against.

Another important consideration is the level of coverage you require. Do you want basic coverage or additional protection for specific items?

Understanding the Claims Process for Property Insurance

To understand how basic property insurance is essential for homeowners, it’s important for you to familiarize yourself with the claims process. When you experience damage to your property, the claims process is what allows you to seek compensation from your insurance provider.

It typically involves the following steps. First, you need to notify your insurance company about the damage as soon as possible. Then, an adjuster will be assigned to assess the extent of the damage and determine the coverage amount.

Next, you’ll need to provide documentation and evidence of the damage, such as photographs or receipts. Your insurance company will then review your claim and make a decision on whether to approve or deny it. If approved, you’ll receive the compensation to repair or replace the damaged property.

Understanding this process is crucial to ensure a smooth and successful claims experience.

Conclusion

In conclusion, having basic property insurance is essential for homeowners. It provides protection for your home and belongings against unexpected events such as fire, theft, or natural disasters.

With coverage options and benefits tailored to your needs, property insurance gives you peace of mind knowing that you’re financially protected.

When selecting property insurance, consider factors such as coverage limits, deductibles, and policy premiums.

Lastly, understanding the claims process ensures a smooth and efficient experience in the event of a loss.